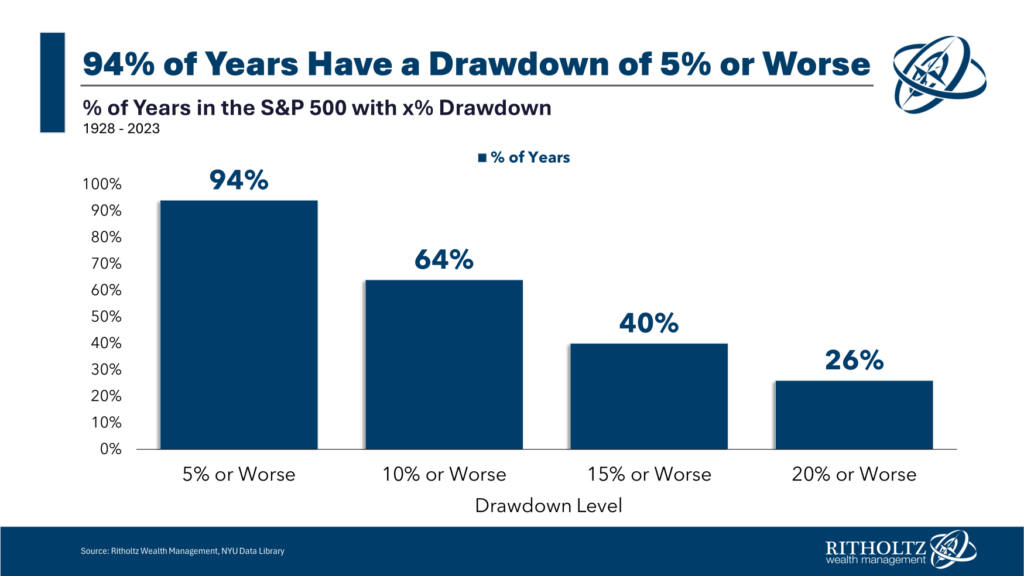

Recently, the S&P500 has experienced a correction of more than 5%. Since it has been a while that we have seen markets decline it is helpful for us to be reminded this is normal behavior for stock market investments. For investors to be forewarned is to be forearmed. Knowing and preparing for volatility is important so you can stay invested within your risk tolerance.

Examine the table below to see the average volatility of the S&P500:

Please note we have been very pleased that our CommonWealth model portfolios have assisted our clients during this recent downturn to stay within their risk tolerance and have navigated this recent downside quite well. Although the S&P500 has experienced what is so far a normal drawdown, our balanced portfolio models have significantly limited the negative volatility.

We allow investors to participate in market upside and have a comprehensive strategy in place to manage risk. For more information, we invite you to call us to discuss how our CommonWealth Portfolios can help you stay invested through market cycles so you can get the rewards of long-term investing.