“Know what you own and why you own it.”

~ Peter Lynch

A foundational principle of money management is to own quality investments.

Well-managed companies with financial strength, high profitability, and competitive advantages should provide superior risk-adjusted returns over the long-term.

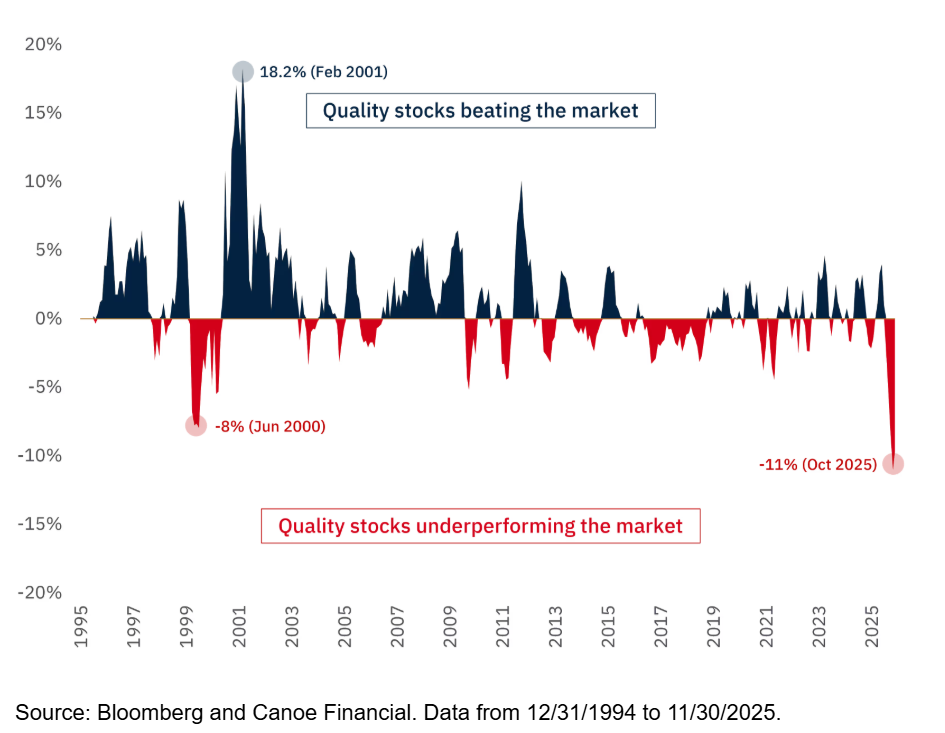

Yet, there are often significant periods when quality stocks can appear to be less attractive if they are not “beating the market” for a time.

This chart shows how unpopular quality stocks can become:

Source: Bloomberg and Canoe Financial. Data from 12/31/1994 to 11/30/2025.

As we know, stock markets have been rising and investors have benefitted.

The chart indicates we may currently be experiencing one of those times when quality stocks are relatively less popular as investors simply chase what is going up.

But we believe in owning quality stocks over time because:

- Stock markets eventually “revert” to rewarding quality investments

- Quality is most important during downturns

While there is euphoria in stock markets, people care less about quality. Yet, the factors that determine superior investments do not change.

When the next downturn in the stock market occurs, we will certainly value proper risk management once again and we will be very happy to be invested in quality!

“Price is what you pay, value is what you get.”

~Warren Buffett