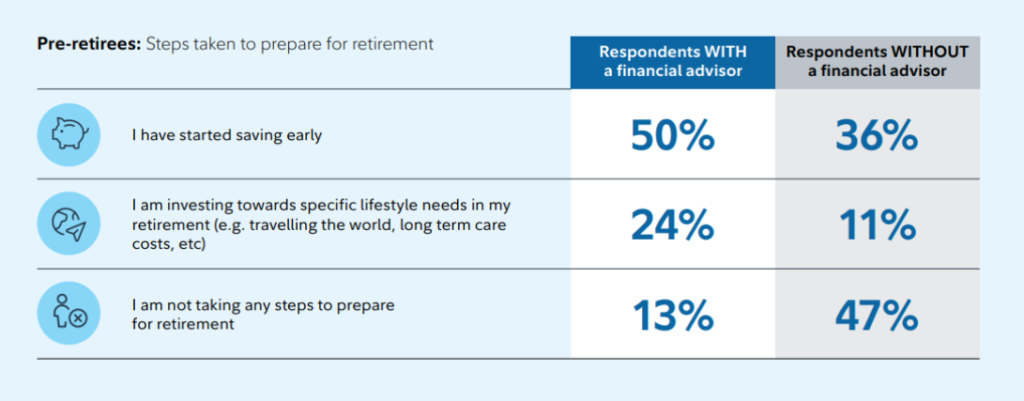

According the Fidelity Retirement Report 2025, nearly half of Canadians without a financial advisor are not taking any steps to prepare for retirement! (see chart below).

Our role is to keep you informed and help you meet your long-term financial goals:

The deadline to make an RRSP contribution is Monday, March 2, 2026 for the 2025 tax year.

- You can find your personal contribution limit on your Notice of Assessment (NOA) from Canada Revenue Agency and confirm with your Tax Advisor.

Your TFSA contribution limit is $7,000 for 2026.

- You can contact Canada Revenue Agency and your Tax Advisor for the details of any contribution room you may be entitled to from past years.

Call Us Today To Discuss:

- How you can maximize the benefits of your RRSP and/or TFSA

- How your investments in your RRSP and TFSA can be complementary

- Retirement strategies that are right for you

- Estate Planning Techniques

Let us know if you are interested in a complimentary copy of the Fidelity Retirement Report 2025!

Fidelity Retirement Report 2025, page 19.