When markets make new all-time highs they can still keep rising for quite some time – and nobody knows when that will change.

At times such as these, when stock markets are high, investors especially need effective risk managment.

Our “pension-style” portfolio models select specific funds which combine multiple protective strategies:

- A balanced, diversified, multi-asset strategy

- Active managers that can lower risks within portfolios

- Tactical strategies to raise cash and move to more conservative holdings

- Style diversification that spreads risk across various investment methods

- Defensive hedging techniques

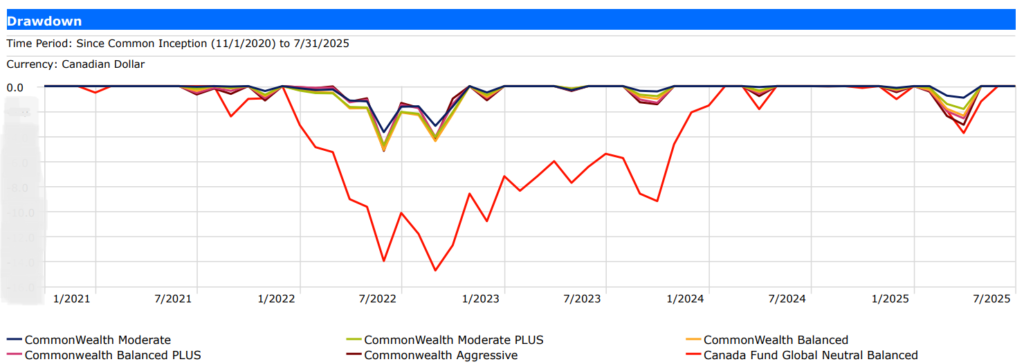

As a result of our actively layered defensive strategies, our portfolios have historically demonstrated considerable downside protection when needed. In the graphic below, the orange bottom line indicates the downside of a balanced “index” compared to our recommended portfolios of funds — the lines above — during some previous market downturns.

Once again, markets may continue to perform positively for some time but historically they have eventually corrected.

While we can’t predict corrections, the important thing is to be prepared!

Over the long-term, strategies that mitigate losses can have very positive effects on investment results.

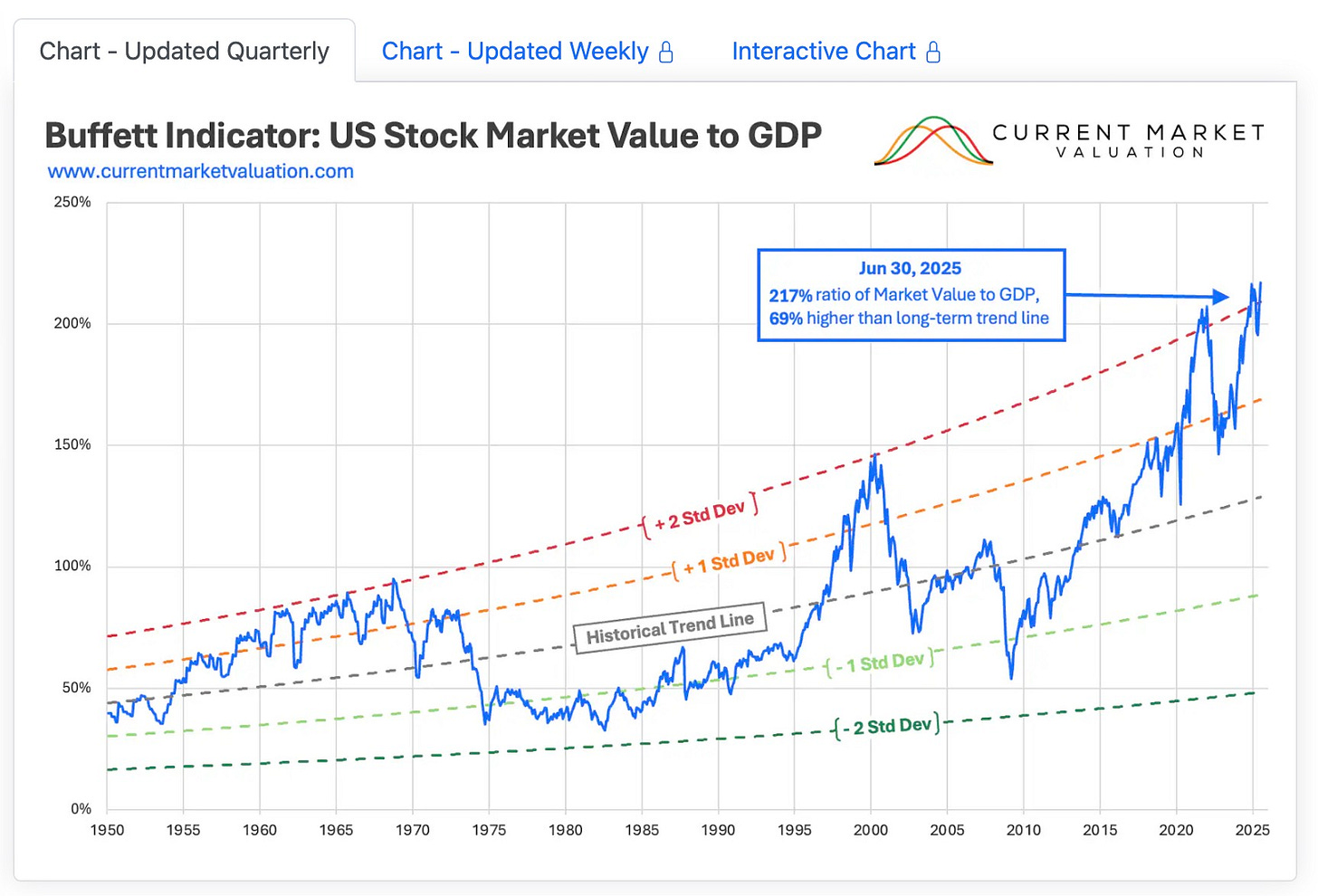

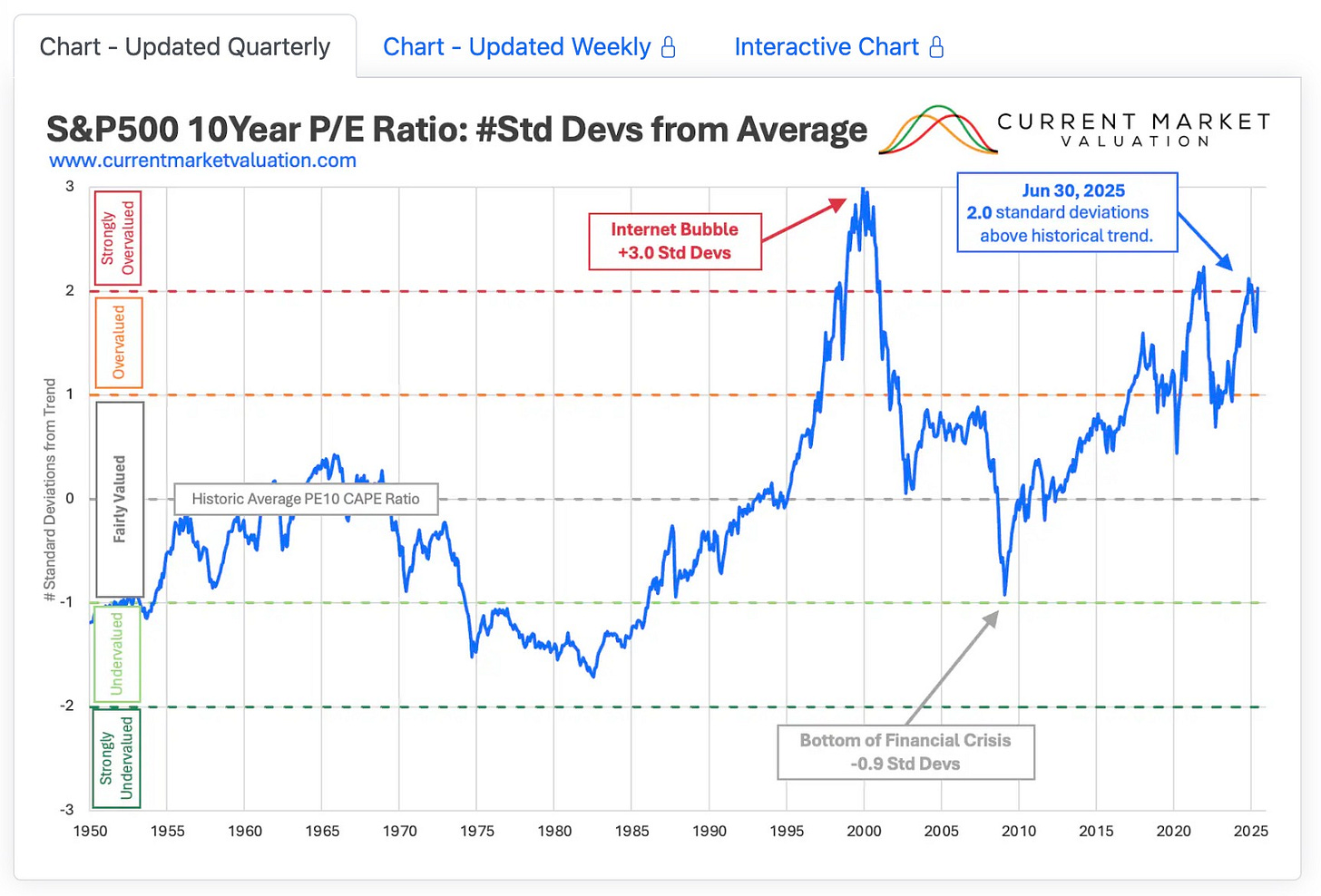

The next two charts indicate that stock markets are currently quite highly valued indeed.

To learn more about how we manage our portfolios, please visit: https://cwealth.ca/serving-clients/portfolios/

We now exclusively recommend our own portfolio models to our clients – including ourselves.

If your investments are not managed by us, we invite you to benefit from investing in active markets, but also to incorporate our effective defensive strategies to manage your risk appropriately.

Call us to learn how we can build downside protection for high markets into your investments!

Your CommonWealth Team

Past performance is not indicative of future results. The value of investments and the income derived from them can go down as well as up, and investors may not get back the amount originally invested. Any historical returns, expected returns, or projections are for informational purposes only and should not be considered guarantees or assurances of future performance. All descriptions of past performance are unaudited. All investments involve risk, including the potential loss of principal.

Do a friend a favour. Forward this newsletter to friends and family and encourage them to subscribe! https://cwealth.ca/blog/