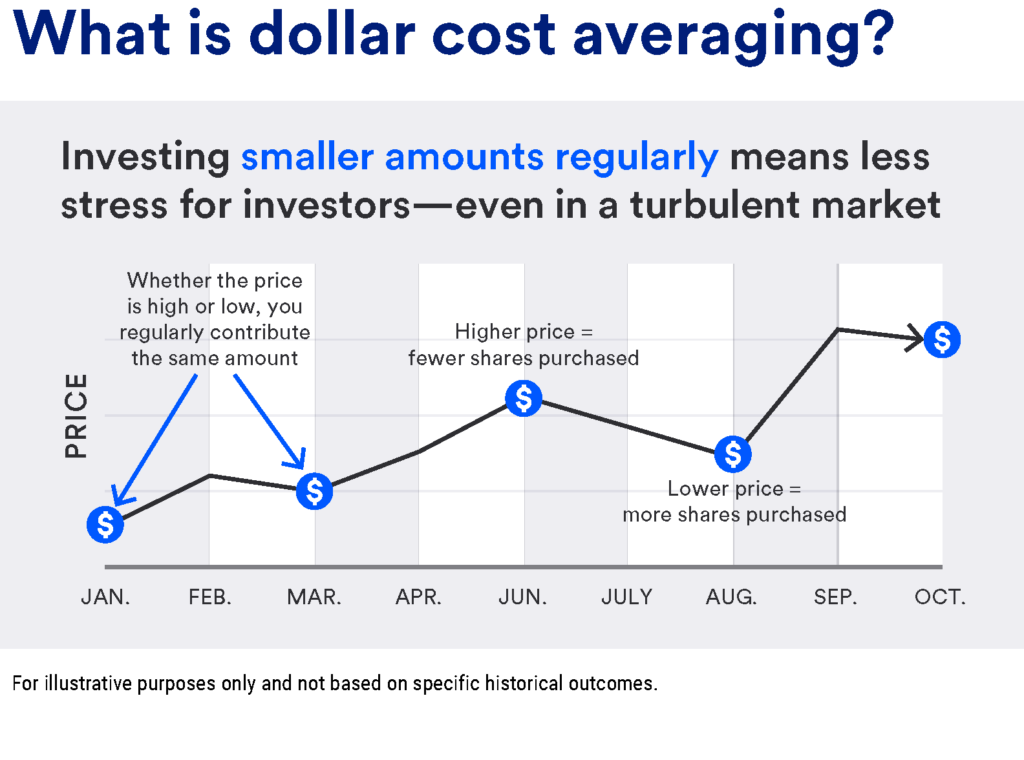

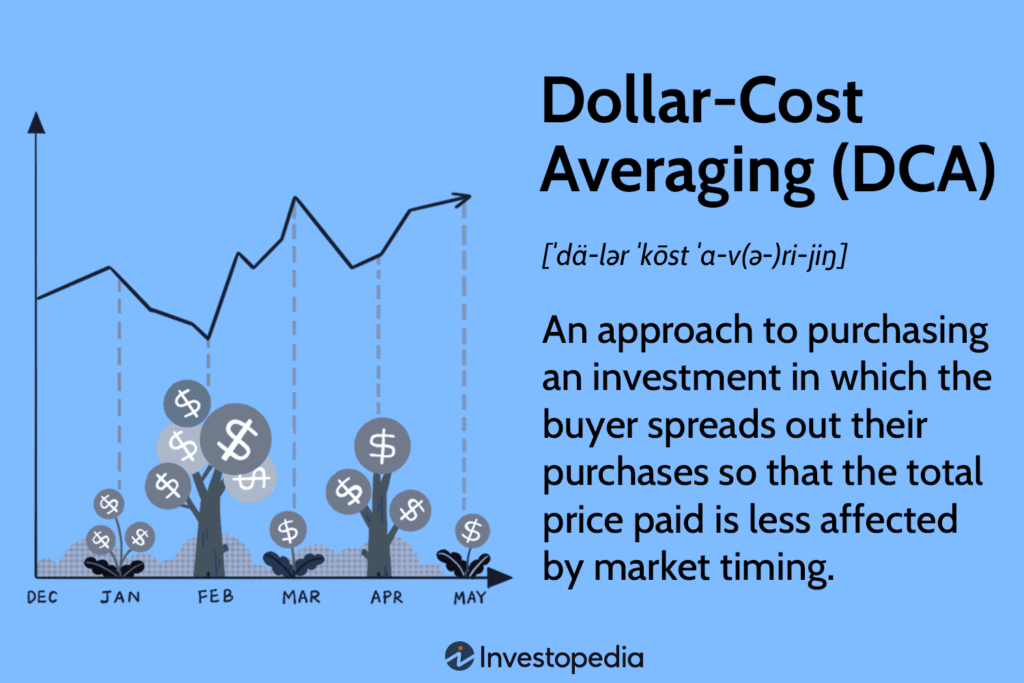

Dollar Cost Averaging is a disciplined method of investing which can deliver significant benefits over time. Spreading purchases out monthly over the calendar year means your investments are less affected by market timing. Accumulating wealth in stocks by systematically moving money into a number of diversified funds represents an efficient way of saving and investing.

Benefits can include lower stress since this program invests smaller amounts regularly which can smooth out your portfolio’s volatility. As markets fluctuate, Dollar Cost Averaging can reduce the purchase price of your investments since when markets go down the same amount of funds will buy automatically more shares at a lower price.

Dollar Cost Averaging can help take emotion out of investing. Our “Life is More” philosophy recommends ways to make investing less stressful and more rewarding. Many people find making many small purchases monthly is often easier than producing a lump sum at the end of the year during RRSP season, and making your contributions in time before the deadline.

Please call your CommonWealth Team to discuss how DCA may help you!

(Chart Sources: U.S. Bank and Investopedia)