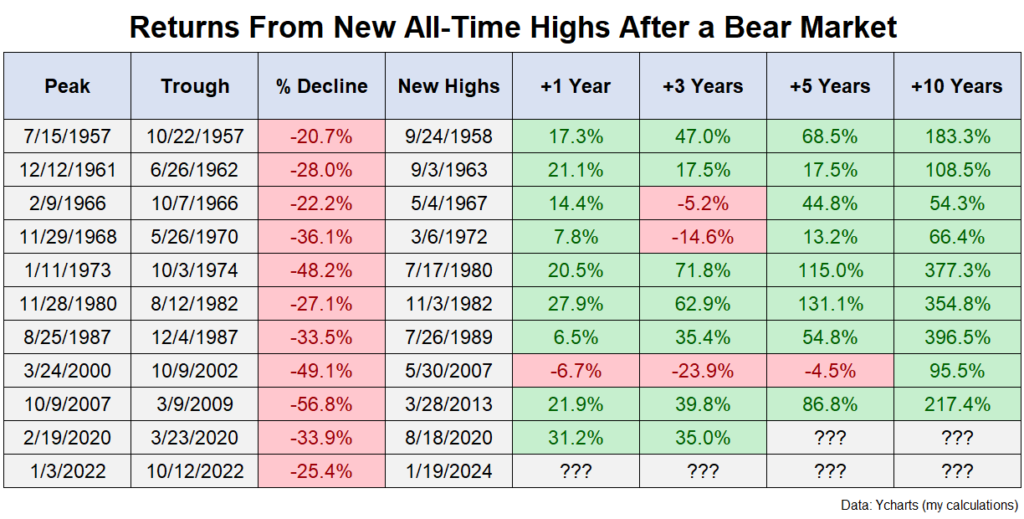

The chart below illustrates historical Bear Market declines for the S&P500 and following recoveries once a new all-time high was eventually achieved. On January 19, 2024 a new high was recorded following the Bear Market of 2022.

Here are a few general observations: 1) Market declines can be significant. 2) Market recoveries can also be significant. 3) Declines and recoveries can potentialy last a long time. 4) A balanced and tactical strategy can help long-term investors to navigate Bear Markets and participate in Bull Markets. 5) If we want to experience Bull Markets in stocks we must accept the realities of the chart below:

*Historical results do not guarantee future results.

Call us at 416.258.8907 for More Information on our CommonWealth Portfolios