“You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.”

~ Peter Lynch, Fidelity Investments

When stock markets go up for a long period of time investors naturally tend to become complacent.

We forget what it feels like to experience negative market volatility. We need to remember that there are entire calendar years when financial markets go down.

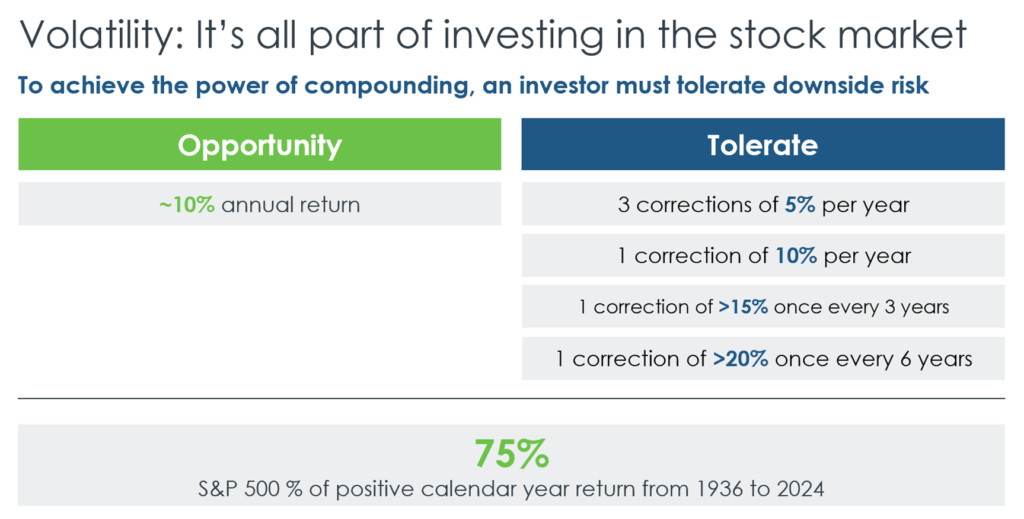

The good news is that historically stock markets have risen on average three out of four calendar years:

To achieve the longer-term opportunity provided by investing in stocks we must be prepared to tolerate fairly frequent and often considerable corrections over any single market cycle.

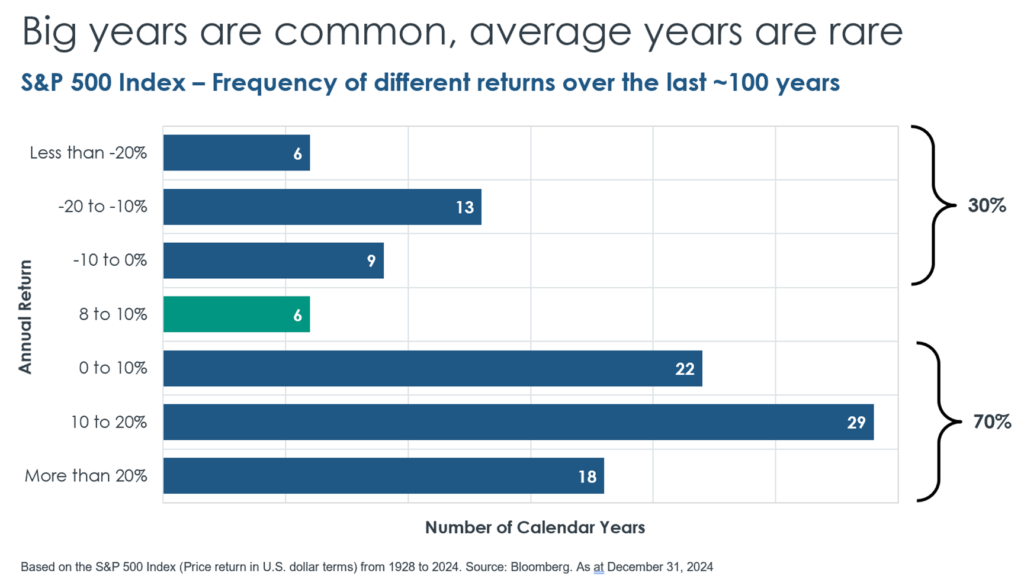

However, we should also know that big years have been much more common than average years:

Dowturns are followed by recoveries which balance out down years, average years, and big years.

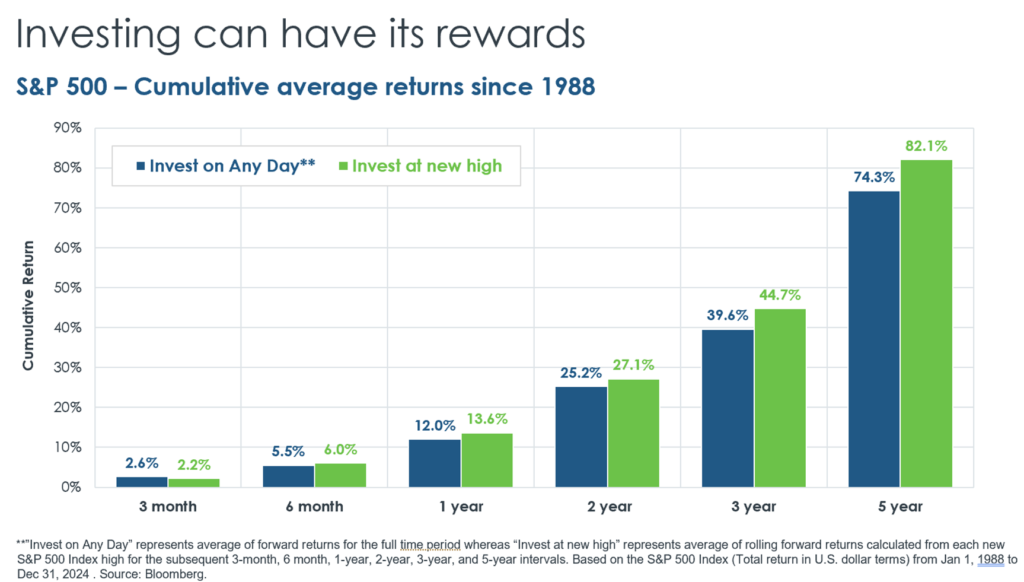

For example, from 1988 to 2024 there was truly a great deal of market volatility!

Nevertheless, investors who only bought the S&P500 at that market’s highs still achieved cumulative returns for the following 5-year periods as follows:

The bottom line is that there are relatively considerable rewards for investing in stocks but we must know about and be prepared for extensive periods when our investments experience signficant declines.

Therefore, we believe it is crucial:

- To invest in the stock market only as much as your risk tolerance allows

- To properly consider your time horizon for investing

- To structure your investments to adequately meet your cash-flow needs

- To factor tax-advantages into your investment funds wherever possible

- To own well-managed, quality investments that participate in recoveries

Most of all we have found that people succeed with professional financial advice.

We get to know your personal situation and guide your investment program.

When you need a sounding board, you know where to find us!

The CommonWealth Team

“I’ve found that when the market’s going down and you buy funds wisely, at some point in the future you will be happy

~ Peter Lynch, Fidelity Investments