“The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.”

~Warren Buffett

One of the greatest investors of all time, Warren Buffet, will retire at the end of this year. What made him so successful was, in part, his crucial observation that human nature tends to work against investors.

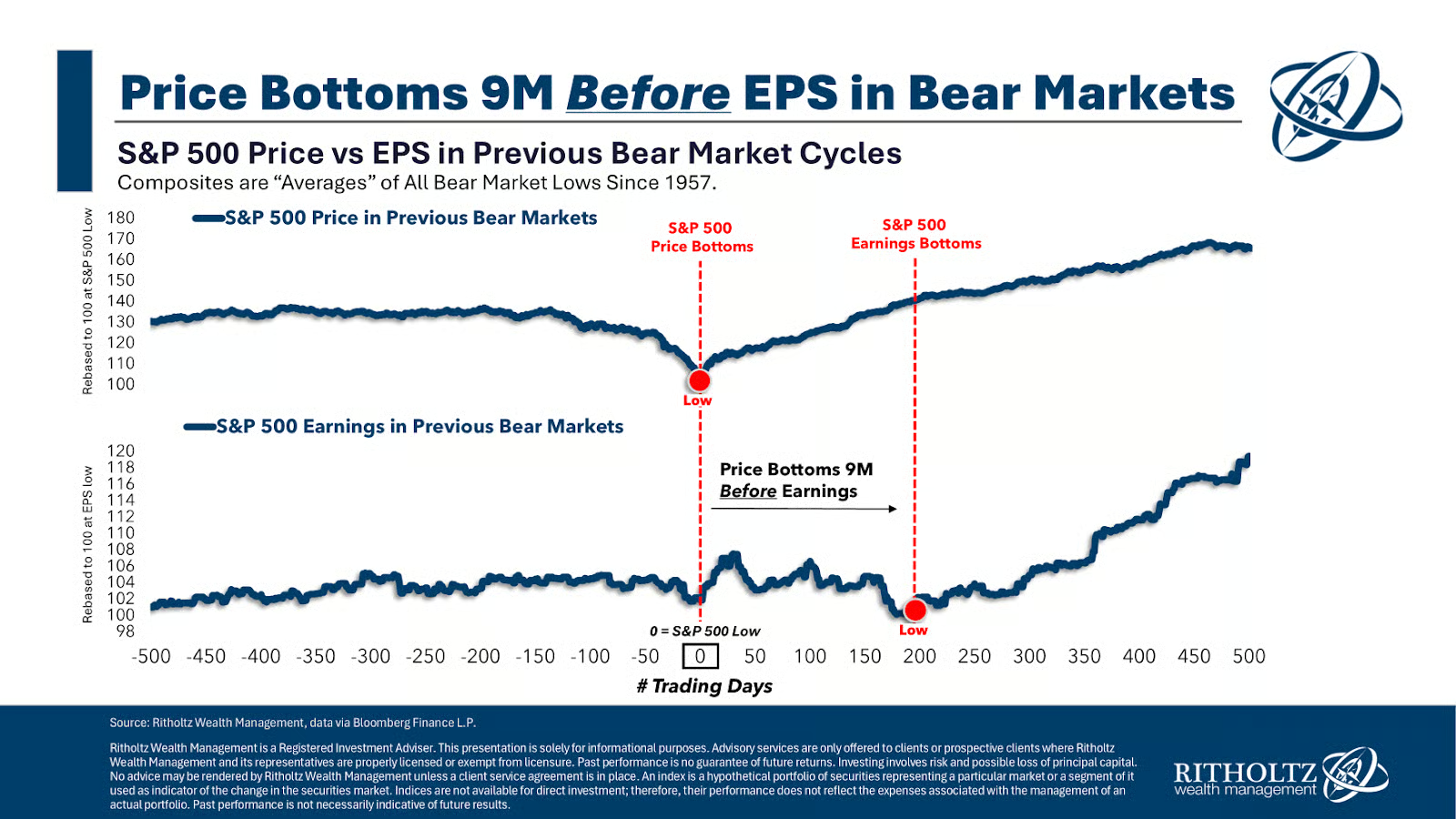

While we are all tempted to make decisions based upon the news of the day, Mr Buffet discovered one secret to investing is that stock prices are forward looking. This means stock prices tend to decline in advance of an economic downturn and to advance in anticipation of an economic recovery.

Warren Buffett, was able to “buy low and sell high” by looking forward rather than following the crowd.

We have found that most people do not have the time nor the inclination to invest their own capital.

Investing for oneself can be very difficult since news headlines (positive or negative) can result in excessive levels of investor sentiment (positive or negative) which are, in fact, contrary market signals.

If you would like to know more about our “pension-style” solution to manage your wealth, please call us to set up a time to discuss your financial goals.

“Be fearful when others are greedy and greedy when others are fearful.”

~Warren Buffett