“There is a symmetry to bear markets in the short-term. In the long-term there is an asymmetric relationship between bull and bear markets. You just have to survive the short run to get to the long run.”

~ Ben Carlson

Bulls and bears represent stock markets because of the way they attack. Bulls fight by charging forward and thrusting upward while bears swipe downwards.

When we zoom out to compare bull markets to bear markets over the long run, we note a clear assymetry between them in terms of duration and magnitude. Stocks tend to take escalator up slowly but take an elevator down quickly!

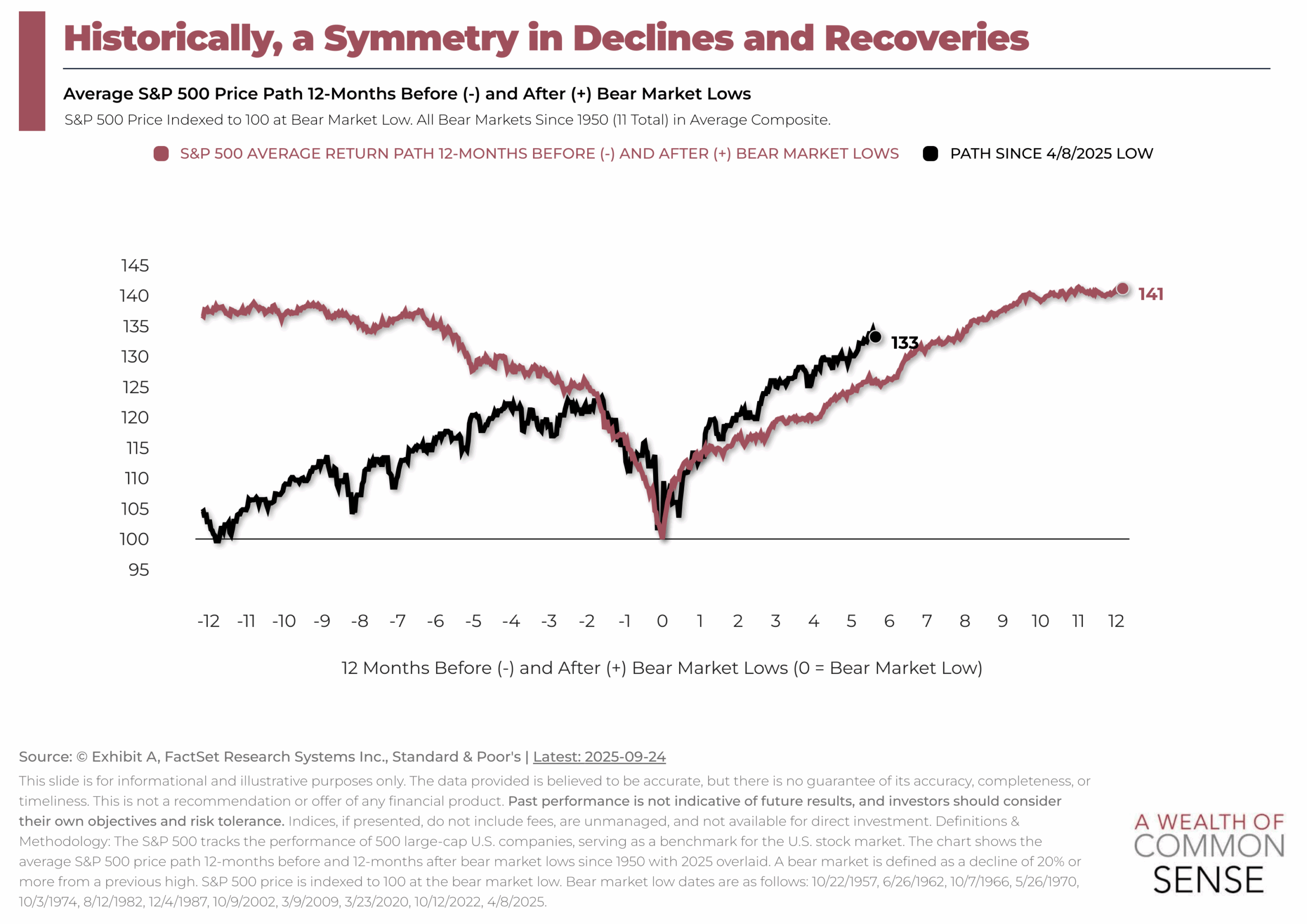

Yet, as we see in this chart below, the rewards of staying invested in stocks have been significant since bull markets have historically lasted much longer and provided a far greater net return. As Ben Carlson said, “…the bull markets completely overwhelm the bear markets. It’s not even close.”

However, when we zoom in closer to this chart of an averaged bear market, we see a much more symmetrical experience. This nature of bull vs. bear markets teaches us that our portfolios need to be carefully prepared for both of these realities.

While it is easy to stay the course during bull markets, the difficulty occurs when it comes time to weather the inevitable bear markets, and we never know when they will happen.

Our unique “pension-style” portfolios help you participate in the upside of financial markets while incorporating multiple financial strategies to manage your risk when markets change.

Read Ben Carlson’s full article, “How Bear Markets Work” click here: https://awealthofcommonsense.com/2025/09/how-bear-markets-work/